Bookkeeping spreadsheet for authors and writers (please share!)

September 22nd, 2014 → 8:56 am @ Carol

I had lunch with a friend, Joules Evans, author of Shaken Not Stirred: A Chemo Cocktail from my writers group and we talked about taxes and the dreaded record keeping.

Joules is a writer (and a very funny one!) and she detests keeping records, but she knows it is important to her success as a business owner (and because I nagged her!)

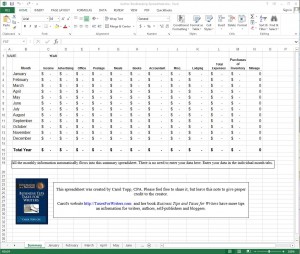

I tried to make it easy on her and shared this spreadsheet I created with her. Joules doesn’t need accounting software like Quickbooks to track her income and expenses. A simple spreadsheet will do.

Then I had an “aha!” moment and thought I’d share it with you all, too.

Author Bookkeeping Spreadsheet

(click to open the spreadsheet)

Please feel free to share this spreadsheet. All I ask is that you do not delete the box on the first tab giving me credit.

I hope it’s helpful!

Carol Topp, CPA

Tags: author, business, record keeping, writer, writing business

The Author’s Guide to Starting a Publishing Company | WD Ghostwriting Services

10 years ago

[…] you want to keep it basic, you can either use the digital or printed version of this accounting spreadsheet created by accountant and author Carol […]

Katharine Godbey

10 years ago

Great spreadsheet! Thanks for sharing this. Where you recommend putting in paypal fees? Misc.?

wendy beasley

10 years ago

Thank you Carol, It’ll be very helpful.

Are your suggestions equally valid for those in Canada?

Happy holidays – Wendy

Carol

10 years ago

Wendy, I’m happy to offer the spreadsheet. I’m not familiar with Canadian taxes or deductions to be able to answer your question! Sorry.

I do know that good record keeping is essential in every country! 🙂

Carol Topp, CPA

Carol

10 years ago

I put my Paypal fees and other banking fees (like credit card fees) in a category called Bank Fees. You could put them under Misc if they are insubstantial. My fees started adding up, so I created a separate category for them.

On the tax return (Schedule C of the Form 1040), I put bank fees under Other Expenses.

Leah E. Good

10 years ago

Wow. What a great resource. Quick question. Putting a dollar amount into the “income” category flows into the “total expenses” category. Is that an error or am I missing something? Also, I see you have “office” and “postage” listed separately. Are they considered different categories on the tax form or do you combine them for that?

Carol

10 years ago

Leah,

Thank you for pointing out that error in the spreadsheet. I fixed it and have uploaded a corrected version.

Postage (you paying to ship out books) could be included as part of Cost of Goods Sold on your tax return. I separated it from Office Expenses, just to have visibility into how much I was spending on postage.

SheilaG @ Plum Doodles

9 years ago

Thanks so much for this info, Carol. So glad I found your site just before tax time!

To Expense Or Not To Expense: What Podcasters Need To Know About Taxes - PowerPress Podcast

9 years ago

[…] separating everything out and keeping good records, starting now. Topp offers a free downloadable business income/expense spreadsheet you can use to keep track of your podcast finances. While Topp’s site is aimed at writers, […]

Brenda S. Anderson

8 years ago

Thank you, Carol, for providing this very helpful resource, and for sharing your expertise with fellow authors.

Vicki

7 years ago

Thank you so much! I have Quickbooks and they are selling and to upgrade costs $$. I hardly use any feature except income/expenses. This is absolutely perfect!

Timeko Whitaker

7 years ago

Hello,

The spreadsheet was extremely helpful. I would like to talk with you by phone when possible. I think we could partner. I have over 50 authors and would love your help. 317.710.9533

Tax Tips for New Authors | Cole Smith Writes

6 years ago

[…] spreadsheet templates available online. Just search ‘free spreadsheet for authors’. This is a nice, simple spreadsheet — great for new authors. Find one you like and use it! Even the most attractive spreadsheet […]