Bookkeeping spreadsheet for authors and writers (please share!)

September 22nd, 2014 → 8:56 am @ Carol

I had lunch with a friend, Joules Evans, author of Shaken Not Stirred: A Chemo Cocktail from my writers group and we talked about taxes and the dreaded record keeping.

Joules is a writer (and a very funny one!) and she detests keeping records, but she knows it is important to her success as a business owner (and because I nagged her!)

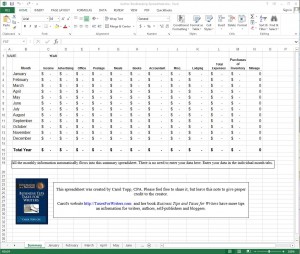

I tried to make it easy on her and shared this spreadsheet I created with her. Joules doesn’t need accounting software like Quickbooks to track her income and expenses. A simple spreadsheet will do.

Then I had an “aha!” moment and thought I’d share it with you all, too.

Author Bookkeeping Spreadsheet

(click to open the spreadsheet)

Please feel free to share this spreadsheet. All I ask is that you do not delete the box on the first tab giving me credit.

I hope it’s helpful!

Carol Topp, CPA

Tags: author, business, record keeping, writer, writing business

The Author’s Guide to Starting a Publishing Company | WD Ghostwriting Services

9 years ago

[…] you want to keep it basic, you can either use the digital or printed version of this accounting spreadsheet created by accountant and author Carol […]

Katharine Godbey

9 years ago

Great spreadsheet! Thanks for sharing this. Where you recommend putting in paypal fees? Misc.?

wendy beasley

9 years ago

Thank you Carol, It’ll be very helpful.

Are your suggestions equally valid for those in Canada?

Happy holidays – Wendy

Carol

9 years ago

Wendy, I’m happy to offer the spreadsheet. I’m not familiar with Canadian taxes or deductions to be able to answer your question! Sorry.

I do know that good record keeping is essential in every country! 🙂

Carol Topp, CPA

Carol

9 years ago

I put my Paypal fees and other banking fees (like credit card fees) in a category called Bank Fees. You could put them under Misc if they are insubstantial. My fees started adding up, so I created a separate category for them.

On the tax return (Schedule C of the Form 1040), I put bank fees under Other Expenses.

Leah E. Good

9 years ago

Wow. What a great resource. Quick question. Putting a dollar amount into the “income” category flows into the “total expenses” category. Is that an error or am I missing something? Also, I see you have “office” and “postage” listed separately. Are they considered different categories on the tax form or do you combine them for that?

Carol

9 years ago

Leah,

Thank you for pointing out that error in the spreadsheet. I fixed it and have uploaded a corrected version.

Postage (you paying to ship out books) could be included as part of Cost of Goods Sold on your tax return. I separated it from Office Expenses, just to have visibility into how much I was spending on postage.

SheilaG @ Plum Doodles

8 years ago

Thanks so much for this info, Carol. So glad I found your site just before tax time!

To Expense Or Not To Expense: What Podcasters Need To Know About Taxes - PowerPress Podcast

8 years ago

[…] separating everything out and keeping good records, starting now. Topp offers a free downloadable business income/expense spreadsheet you can use to keep track of your podcast finances. While Topp’s site is aimed at writers, […]

Brenda S. Anderson

7 years ago

Thank you, Carol, for providing this very helpful resource, and for sharing your expertise with fellow authors.

Vicki

6 years ago

Thank you so much! I have Quickbooks and they are selling and to upgrade costs $$. I hardly use any feature except income/expenses. This is absolutely perfect!

Timeko Whitaker

6 years ago

Hello,

The spreadsheet was extremely helpful. I would like to talk with you by phone when possible. I think we could partner. I have over 50 authors and would love your help. 317.710.9533